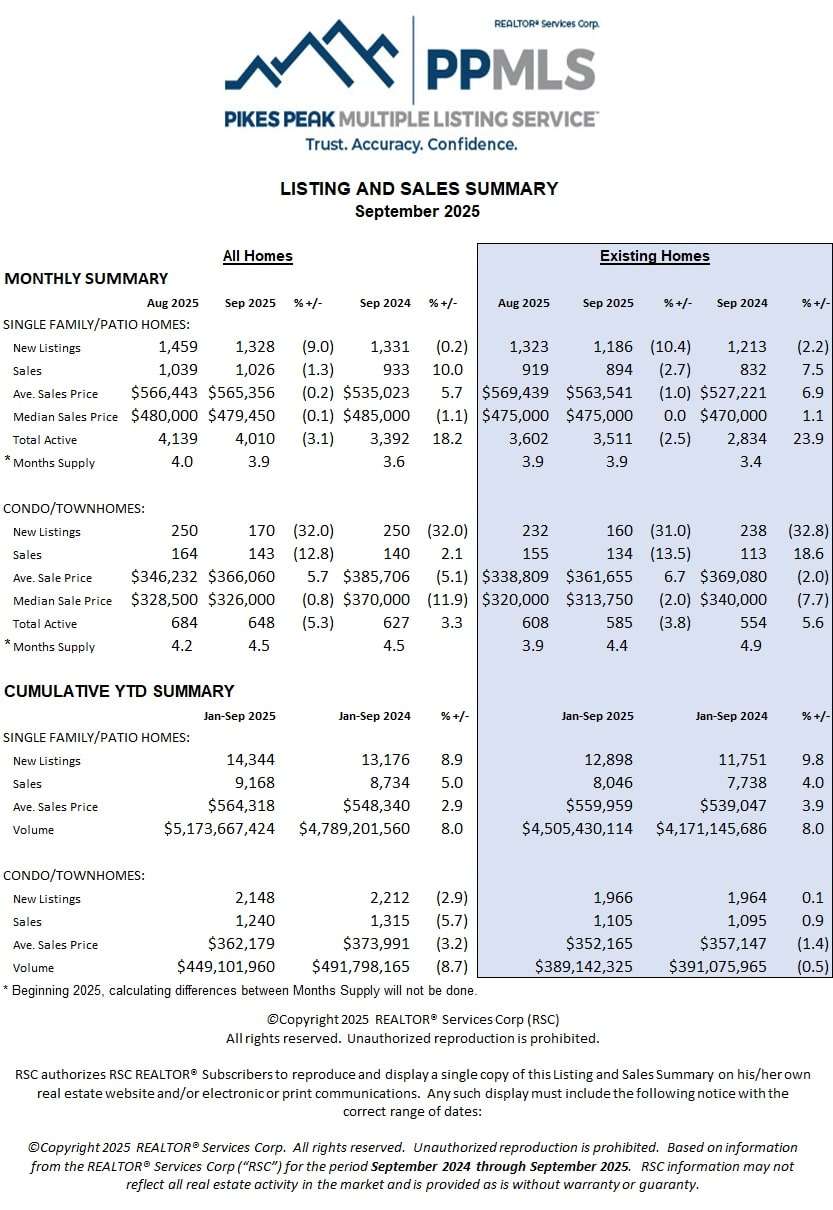

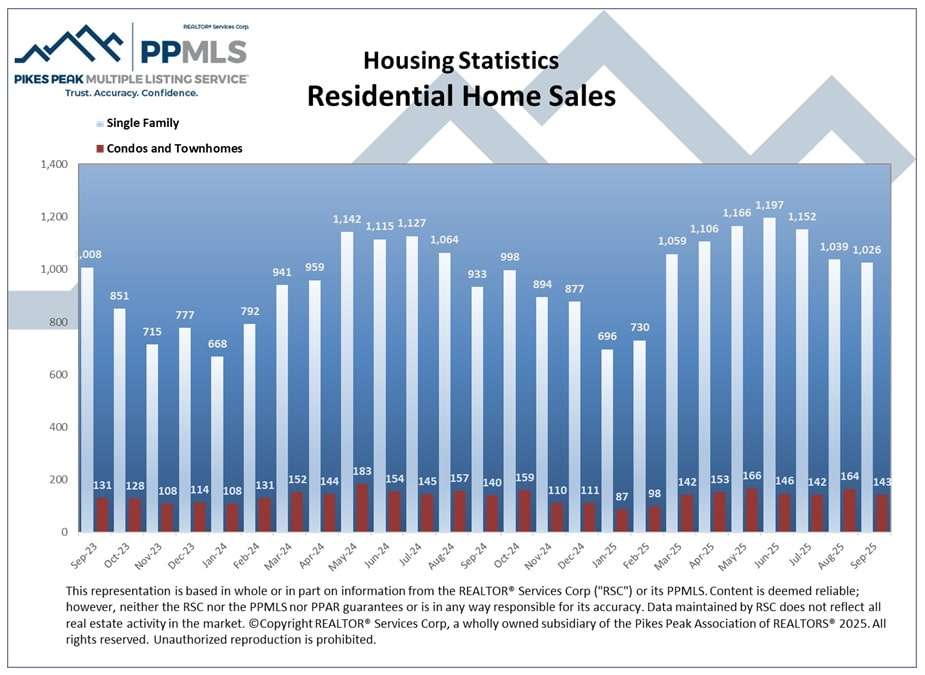

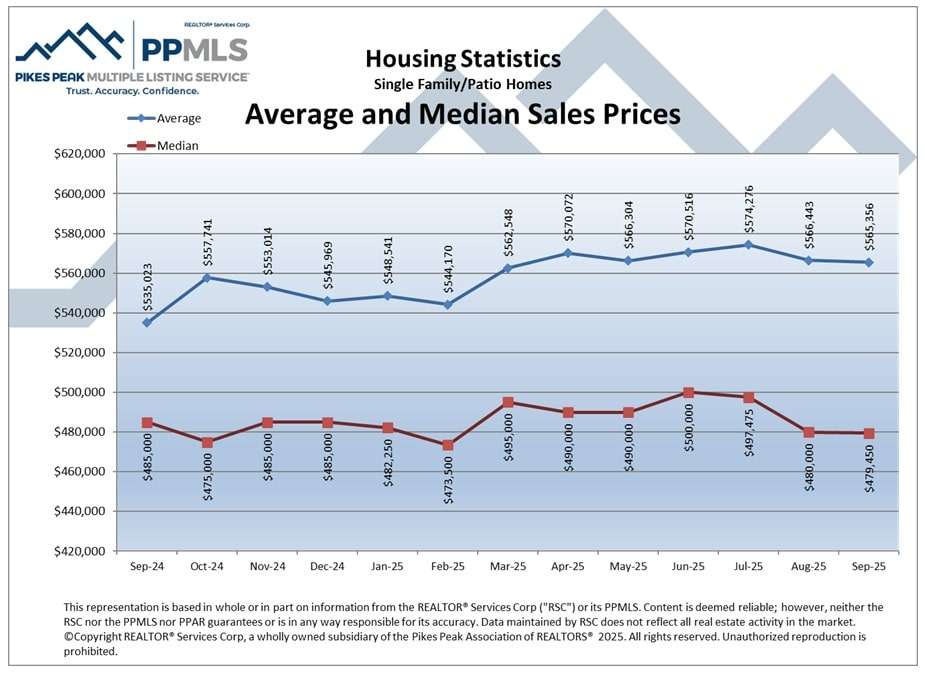

The Colorado Springs housing market in September 2025 showed signs of a typical seasonal cooldown while remaining stronger than last year overall. Single-family and patio home sales dipped slightly month-over-month, from 1,039 in August to 1,026 in September, but were still up 10% compared to September 2024. New listings also decreased by about 9% from August, signaling that many sellers paused heading into fall. Average sales prices remained stable at $565,356, nearly identical to August’s figure and up 5.7% year-over-year, while the median price held firm at $479,450. Inventory eased slightly month-to-month, with 4,010 active listings (down from 4,139 in August), but was still 18% higher than the same time last year—offering buyers more choices than in 2024. Days on Market increased to 54, reflecting a slower pace as the market transitions into autumn.

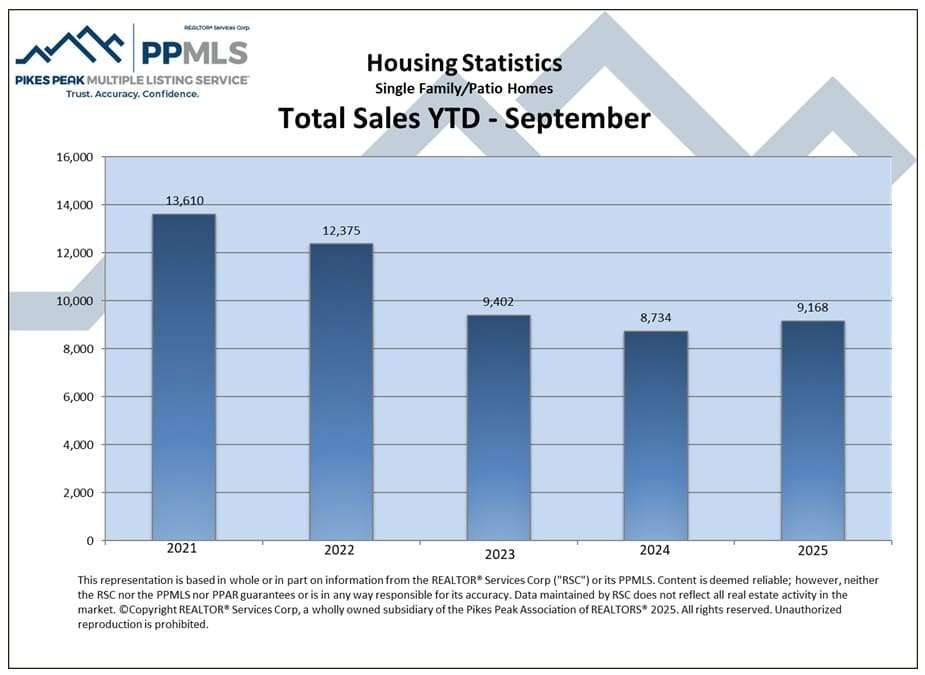

Year-to-date figures show continued resilience despite higher interest rates and cautious consumer sentiment. Through the first nine months of 2025, total single-family and patio home sales reached 9,168—about 5% higher than last year—with average prices up 2.9% year-over-year to $564,318. Condo and townhome activity softened slightly, with listings down 3% and prices off around 3%, indicating more stability in the single-family segment. While inventory levels and market times suggest a shift toward balance, demand has proven steady, keeping prices from falling. Overall, Colorado Springs remains a healthy and active market heading into Q4 2025, with opportunities for both buyers and sellers to succeed depending on strategy and timing.

If you felt the market cool slightly in September, you’re not wrong. Inventory eased from August levels, sales held surprisingly steady, and prices stayed resilient. Here’s the full breakdown.

Make sure to reach out to us today for the latest housing inventory in Colorado Springs! 719 367-6880

Fast take (single-family & patio homes unless noted)

- Sales: 1,026 closings (-1.3% MoM) and +10.0% YoY vs. Sept ’24’s 933.

- New listings: 1,328 (-9.0% MoM) and essentially flat YoY (1,331 a year ago).

- Average price: $565,356 (-0.2% MoM) and +5.7% YoY.

- Median price: $479,450 (-0.1% MoM) and -1.1% YoY vs. $485,000 last year.

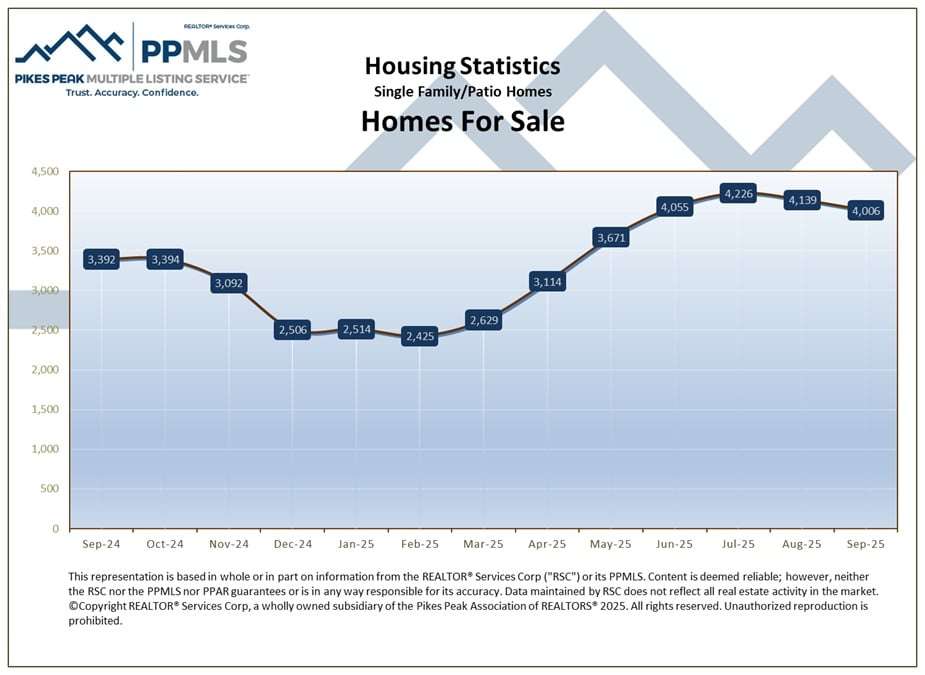

- Active inventory: 4,010 (-3.1% MoM) and +18.2% YoY (3,392 last year).

- Months of supply: 3.9 (down from 4.0 in Aug; up from 3.6 last year).

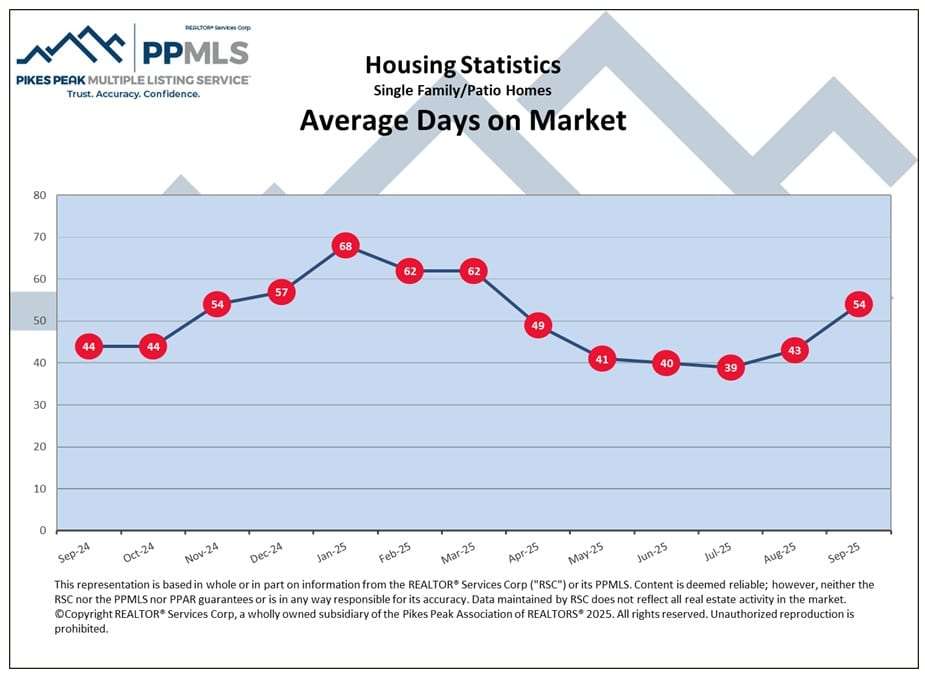

- Average Days on Market: 54 days (up from 43 in Aug; up from summer lows ~39–41).

Month-to-Month: August → September 2025

- Listings pulled back: 1,459 → 1,328 (-9.0%). Seasonal taper plus some sellers pausing until rates and fall demand settle.

- Closings basically held: 1,039 → 1,026 (-1.3%). Demand proved sticky.

- Prices steady: Avg $566,443 → $565,356 (-0.2%); Median $480,000 → $479,450 (-0.1%). That’s classic fall leveling rather than a price slide.

- Inventory eased: 4,139 → 4,010 (-3.1%); months supply 4.0 → 3.9.

- Days on Market rose from 43 → 54, reflecting slower fall absorption and more price-sensitive buyers.

Condo/Townhome snapshot (MoM)

- New listings: 170 (-32.0%).

- Sales: 143 (-12.8%).

- Avg price: $366,060 (+5.7%).

- Median price: $326,000 (-0.8%).

- Active: 648 (-5.3%).

- Months supply: 4.5 (up from 4.2).

Year-over-Year: September 2024 → September 2025

- Sales up: 1,026 vs. 933 (+10.0%). Despite higher holding costs, buyer pool remains engaged.

- Listings flat: 1,328 vs. 1,331 (-0.2%). New supply isn’t flooding the market.

- Average price up: $565,356 vs. $535,023 (+5.7%).

- Median price slightly lower: $479,450 vs. $485,000 (-1.1%)—mix matters; more entry-level/median-leaning sales this September.

- Active inventory higher: 4,010 vs. 3,392 (+18.2%), which is giving buyers more choice than last fall.

- Months supply: 3.9 vs. 3.6—still a seller-tilted “balanced-ish” band, not a buyer’s market.

- Days on Market trending higher than last fall; September printed 54 vs. mid-40s a year ago.

Condo/Townhome (YoY)

- New listings: 170 vs. 250 (-32.0%).

- Sales: 143 vs. 140 (+2.1%).

- Avg price: $366,060 vs. $385,706 (-5.1%).

- Median price: $326,000 vs. $370,000 (-11.9%).

- Active: 648 vs. 627 (+3.3%).

- Months supply: 4.5 (flat YoY).

Inventory & pace check

- Homes for sale: peaked around 4,226 (July) and stepped down to 4,139 (Aug) and 4,006 (Sept).

- Days on Market: bottomed around 39–41 days in early summer, climbed to 54 in September—right in line with the usual post-summer slowdown.

YTD context (Jan–Sept)

- Single-family/patio home sales YTD: 9,168 vs. 8,734 in 2024 (+5.0%).

- Average price YTD: $564,318 vs. $548,340 (+2.9%).

- Condo/townhome sales YTD: 1,240 vs. 1,315 (-5.7%); average price $362,179 (-3.2% YoY).

What this means

For sellers

- Pricing precision matters. Buyers are choosy, DOM is rising, and stale listings get discounted. Aim for clean condition + right-out-of-the-gate pricing to capture the first two weeks of traffic.

- You still hold an edge in many neighborhoods (sub-4 months supply), but it’s not spring 2021—expect normal negotiations (inspection credits, modest concessions, or rate buydowns).

For buyers

- Selection is better than last year, and fall brings more leverage. With DOM up and inventory stable, consider seller credits to reduce your payment via temporary or permanent buydowns.

- Watch micro-markets: some price bands remain competitive with near-summer absorption; others sit longer and are ripe for value.

For investors

- Condo/townhome YoY price softness + stable supply may open interesting cash-flow or BRRRR plays—just underwrite conservatively given HOA/insurance dynamics and rate volatility.